· Cypher Labs HQ · CBDC · 4 min read

Stablecoin vs Central Bank Digital Currency (CBDC): Understanding the Difference

In recent years, digital currencies have surged in popularity, transforming the way we perceive and use money. Two of the most prominent digital currency innovations are Stablecoins and Central Bank Digital Currencies (CBDCs).

In recent years, digital currencies have surged in popularity, transforming the way we perceive and use money. Two of the most prominent digital currency innovations are Stablecoins and Central Bank Digital Currencies (CBDCs). While both offer digital alternatives to fiat currency, they operate under different systems and mechanisms. In the Indian context, the development of CBDCs is particularly noteworthy due to the existing NPCI (National Payments Corporation of India) infrastructure, which provides a significant advantage for the country’s CBDC implementation.

What is a Stablecoin?

Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a specific asset or basket of assets. These assets are usually fiat currencies like the US dollar or commodities like gold. The goal of stablecoins is to reduce volatility typically seen in other cryptocurrencies like Bitcoin.

Types of Stablecoins:

- Fiat-collateralized Stablecoins: Backed by fiat currency reserves, like USDC or USDT.

- Crypto-collateralized Stablecoins: Backed by other cryptocurrencies, such as DAI.

- Algorithmic Stablecoins: Use algorithms to maintain stability without direct backing, as was attempted with TerraUSD.

What is a Central Bank Digital Currency (CBDC)?

A CBDC is a digital form of a country’s national currency, issued and regulated by the central bank. In India, this would mean that the Reserve Bank of India (RBI) issues and manages the CBDC. The CBDC is a centralized currency, fully backed and guaranteed by the government, much like physical cash.

CBDCs offer several advantages but also come with challenges, particularly in how they function and interact with existing infrastructure.

Advantages of CBDC Infrastructure:

- Government-Backed Stability: CBDCs are government-issued and backed by the central bank, ensuring trust and price stability.

- Integration with Existing Infrastructure: India’s NPCI network provides a ready-made, scalable, and sovereign infrastructure that can support CBDC adoption.

- Financial Inclusion: CBDCs can provide broader access to digital financial services in rural or underbanked areas.

- Combating Cross-Border Fraud: CBDCs support compliance with AML and ATF regulations by enabling government monitoring.

- New Opportunities for Banks: Banks can innovate with CBDC staking models, unlocking new income streams and financial products.

Challenges Faced by CBDC Infrastructure:

- Public Digital Infrastructure Inefficiencies: Slower decision-making, outdated technology, and limited innovation are common in government-run systems.

- Privacy Concerns: Government-monitored CBDCs raise concerns about user surveillance and financial privacy.

- Regulatory Challenges: Striking the right balance between oversight and innovation is essential but difficult.

- Cross-Border Interoperability: Technical and regulatory hurdles must be overcome to integrate Indian CBDCs with international systems.

CBDCs vs Stablecoins in the Indian Context

A well-implemented Indian CBDC could offer significant advantages over stablecoins, especially given the robust NPCI framework. While stablecoins need complex mechanisms like reserves or algorithms to maintain their value, an Indian CBDC would rely on existing fiat structures, using the NPCI network for real-time verification and transaction efficiency.

Challenges for Stablecoins in India:

- Regulatory Uncertainty: Stablecoins, as private initiatives, face stricter oversight, making CBDCs more favorable.

- Cost of Maintenance: Maintaining reserves makes stablecoins more expensive to operate compared to CBDCs.

- Trust and Legitimacy: Government-issued CBDCs may enjoy higher public trust, especially when built on NPCI.

Key Differences Between Stablecoins and CBDCs in India

| Feature | Stablecoins | CBDCs |

|---|---|---|

| Issuer | Private companies | Central Bank (RBI) |

| Backing | Assets or algorithms | Government fiat currency |

| Regulation | Limited, evolving | Government-regulated |

| Infrastructure | Built independently | Backed by NPCI |

| Trust | Varies | High (due to government support) |

Conclusion

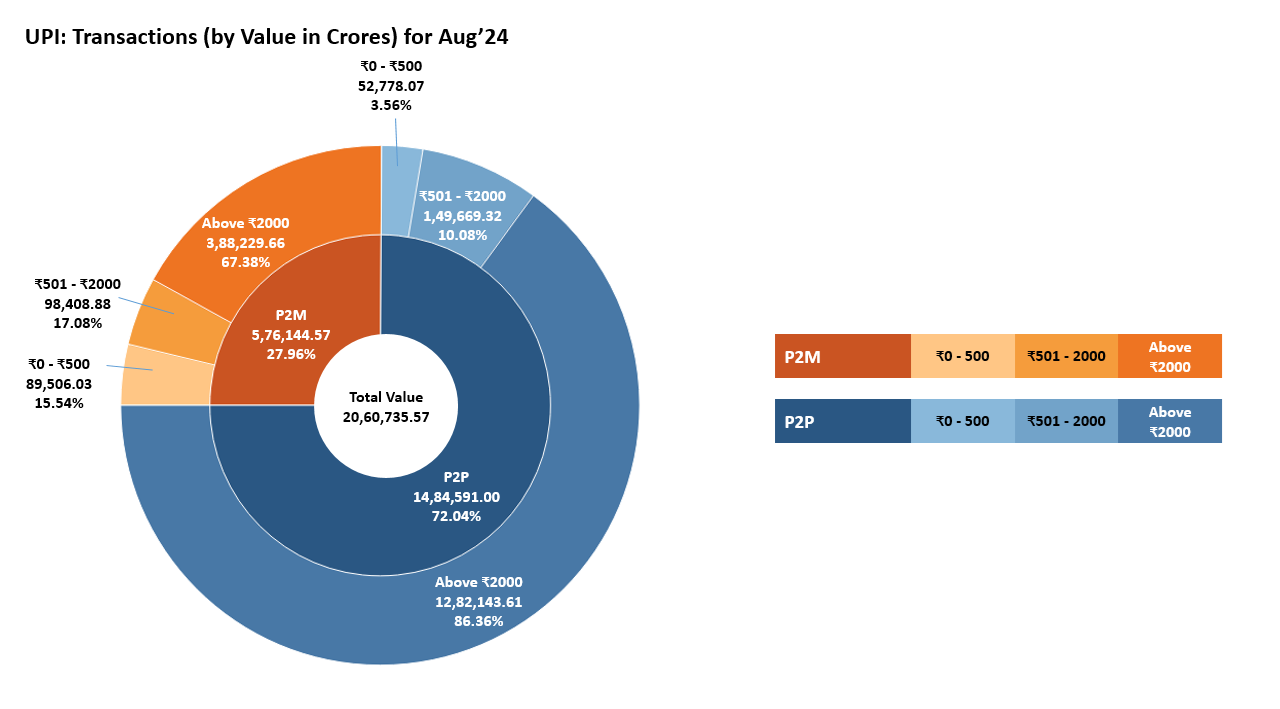

In the Indian context, the development of a CBDC would be significantly bolstered by the existing NPCI infrastructure, which already powers UPI and connects a vast network of banks. This gives India a unique advantage in the global race for CBDC development. Other countries without similar payment infrastructures may find it challenging to replicate this integration of banking networks, identity binding, and real-time transaction validation.

While stablecoins offer a decentralized alternative, their complexity in terms of maintaining value and regulatory scrutiny makes them less appealing compared to a well-regulated, government-issued CBDC in India. Leveraging NPCI’s proven framework, India could create a highly efficient, secure, and scalable CBDC system that addresses both domestic and cross-border payment needs while complying with AML and ATF laws.

Furthermore, while traditional banking models like CASA might be impacted, Indian banks can adapt by staking CBDCs for higher returns, unlocking new business models and revenue streams in the CBDC-driven economy. This ability to innovate within the CBDC framework puts Indian banks in a prime position to capitalize on the next phase of digital finance.