· Aishwary Gupta · CBDC · 4 min read

Do we need CBDC in India?

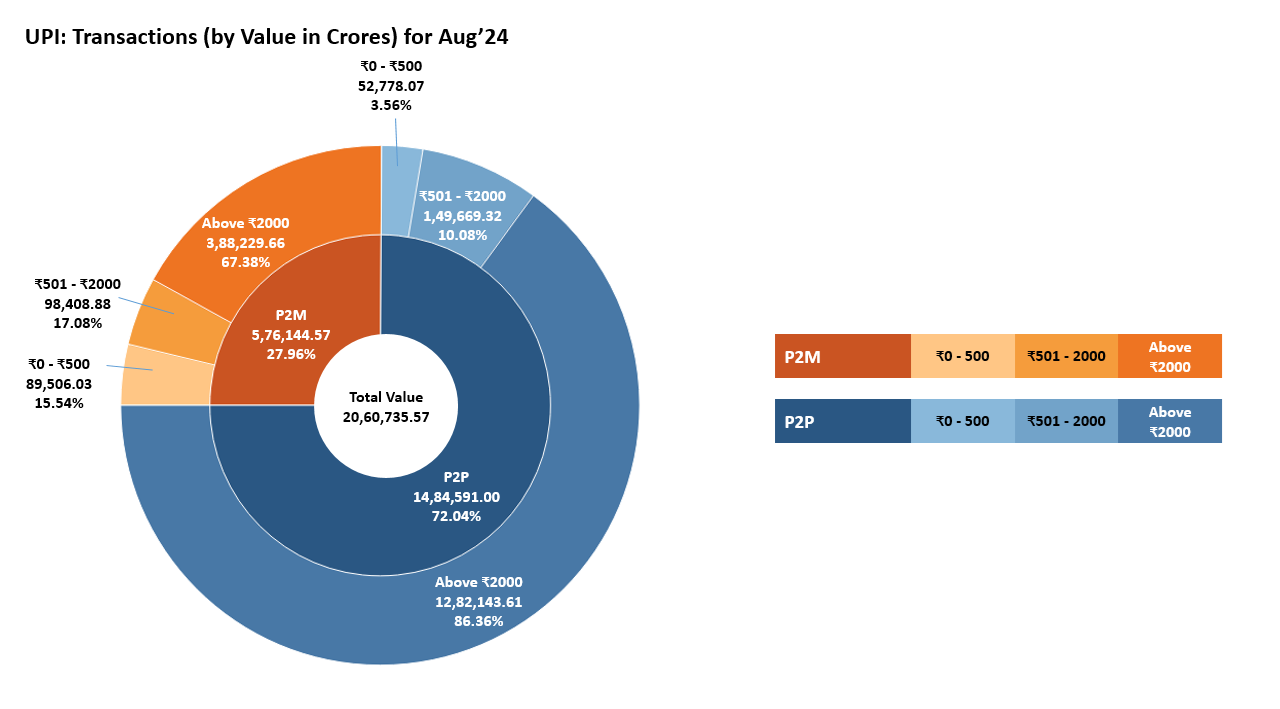

India has witnessed monumental changes in how payments have evolved over the past decade. Not only has the payment infrastructure transformed, but customer behavior and trust in digital payments have also seen a massive spike. Compared to the total volume handled by the Unified Payments Interface (UPI) in January 2022, which was 461 crore, it skyrocketed to over 21,61,000 crore in August 2024, marking a growth of over 4,500 times in just two years.

UPI and CBDC: The Future of Unified Payments in India

However, UPI, though appearing real-time for end-users, is not actually so. UPI serves as a messaging layer between partner banks and conducts settlements between them every two hours, 24/7. As the number of transactions increases, so does the load on the overall infrastructure.

Despite this, UPI remains one of the best systems available. It processes an average of 2,500 transactions per second and is deeply integrated into the Indian payment ecosystem.

Why Build CBDC?

So, when the system works so flawlessly, what could possibly justify further advancements in this space? And why is the NPCI (National Payments Corporation of India) building the Central Bank Digital Currency (CBDC)?

The answer is simple: “To unify the payments and messaging layers into one.”

While the answer may be simple, achieving a unified layer is a monumental task, and it raises several important questions:

- Do we need a Unified Layer?

- Would this Unified Layer (CBDC) replace UPI?

- Can this Unified Layer (CBDC) scale as much as UPI?

- What problems does it solve that the current UPI ecosystem cannot?

- What are the benefits for end users?

- With CBDC accruing no interest and having very limited use in its current format, why should an end user even consider using it?

The most crucial question to consider is: “What value does this new system add?”

The most prominent answer is that, as a Unified Layer, it could significantly reduce intermediaries, eliminate the need for reconciliations, and cut costs—provided that we achieve the necessary scale.

Asset vs. Delivery: A Key Benefit

Let’s explore how all of this can be achieved on the Unified Layer. One of the biggest benefits of leveraging distributed ledgers is the Asset vs. Delivery mechanism.

When we use UPI, payments are made via one layer, while goods and services are delivered through another layer (or means). However, on distributed ledgers, this can be done simultaneously in one seamless process.

Real-World Scenario

Suppose you’re planning a business trip to the US from India, and you’ll need some USD for your expenses during the trip.

Typically, you would go to a Forex dealer and exchange your INR for USD. This transaction happens in two steps:

- You deposit your money into the Forex dealer’s account.

- Once they receive the funds, they release the USD to you.

Problems with the Current System

- Trust: You need to trust the Forex dealer.

- Time: The process is time-consuming.

- Cost: You pay a premium due to the intermediary.

When done on a unified ledger, this can be executed as a single, instant transaction—more convenient, cheaper, and trustless.

Example: Uniswap

Uniswap is a decentralized exchange (DEX) that enables users to swap assets without relying on a centralized third party.

A PvP transaction for asset delivery on Uniswap between USD <> EURO

USDC and EUROC are synthetic assets, each backed 1:1 by their respective fiat currencies. If I need to receive euros and pay in USD, the transaction can be completed in a single step—secure and instantaneous.

Back to CBDCs

If Unified Ledgers are so efficient, is CBDC better than UPI? Technically, yes, but adoption will take time.

Current CBDC Use Cases

- Direct Benefit Transfers (DBT) under government schemes

- Bonuses for bank employees

- Food vouchers for employees

UPI is currently used for nearly everything. Will CBDC take over UPI’s use cases and scale? Unlikely.

Coexistence of UPI and CBDC

In my opinion, the answer is no. Both systems can coexist, each offering distinct advantages and use cases.

Future Use Cases for CBDC

Vertical Scaling

CBDC stack built on distributed ledger enables Asset vs. Delivery and programmable CBDC (pCBDC).

Example: DBT can ensure that benefits are used exclusively for agriculture. This needs:

- Programmable capabilities

- More assets on the CBDC platform

Horizontal Scaling

Horizontal scaling enables CBDC to integrate with other distributed ledgers where assets already exist. CBDC serves as the payment mechanism, completing Asset vs. Delivery across platforms.

Although not widely tested, pilot projects are exploring horizontal scaling’s potential in a regulated environment to unlock the full value of distributed ledgers in India.